A few months back, my wife and I were sitting in the house, arguing about whether to buy something or not (I can’t even honestly remember what it was). As with most people, the majority of our arguments come down to money, or lack of it. We had the money to buy whatever it was that we were arguing about, but it would take quite some time to earn that money back, so was it worth it?

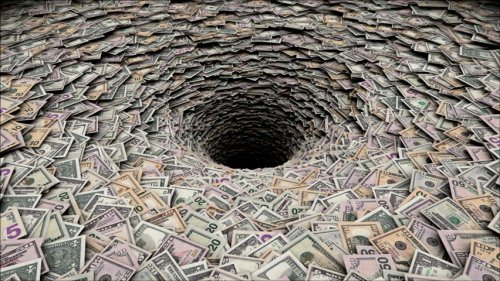

At some point, my wife fetched a pad of paper and a pen and began writing down all of our expenditures, outgoings and incomings. I think it was the first time we’d ever actually looked at just how much our daily lives were costing us. And the result was just plain scary. I couldn’t even see how we were managing to survive.

When you first start off in life, finances are pretty simple, especially if you’re renting. You know how much you earn, you have a few bills which you have to pay, and the rest (if there is any left) goes on enjoyment – going out, new clothes, takeaways, etc. Fast forward a decade or so and you have mortgages to pay, kids to feed, and cars to run. But then there are all the ‘hidden’ regular expenses – everyone needs a mobile phone, there are those extra packages for satellite or cable TV, there are school fees and other associated costs, hairdressers… And then there are the random expenditures – going out for a meal, going shopping, buying stuff on Ebay because you’re bored. And then there are the unexpected expenditures – the car mechanic, the plumber, tax bill.

When I saw that list taking form, I could feel myself beginning to sweat. It was scary.

Money has to be the number one cause of unhappiness in life – it’s definitely the number one cause of arguments in relationships. I realised that the first thing that I need to get on top of was my daily finances. I needed to know just what was coming in and what was going out. Whatever it was that we were discussing buying was immediately put on hold. Chances are, we wouldn’t need it anyway. Before even beginning my quest for happiness, I had to sort out the money issue.

Ordo ab chao (Latin – Order out of chaos)

The best way of getting to grips with your finances, apart form employing the services of a professional accountant, is to keep a Money Diary. Begin by making a list of every single penny or cent which comes in and goes out. Be brutally honest with yourself. Type this up in Word or Excel or, if you’re like me, Open Office, and print it out. This will help keep reality in check. Next, get yourself a notebook or diary (I prefer Moleskines) and, each day, write down what money you’ve received and what you’ve paid out.

And I mean every single penny (or cent).

Bought a car? Write it down. Bought an ice cream? Write it down. Sold an old sweater on Ebay? Write it down. Do this daily and you’ll soon begin to see where you’re leaking money (do you really need an extra sports package on TV?). Be strict with yourself and it will help you take back some control of your life. After all, it’s your money. Advertising executives get paid the big bucks specifically to relieve you of your hard-earned cash, whether you originally wanted to or not. By knowing what you can and can’t afford, you’ll begin to start thinking twice about those ‘special offers’.

Having any form of debt brings misery (there used to be prisons for debtors) and that’s exactly what mortgages, loans and credit cards are – debt. Aim to get to the point where you can actually save up money and pay in cash (or by bank transfer, so long as you actually own the funds and aren’t borrowing them at interest). With your finances safely under control, you can begin to breathe more easily and actually start planning a real life, because monthly installments don’t bring happiness, just stress and debt.

Remember, this is just the first stepping stone, but it may also be the most difficult. It’s far too easy to play ostrich with your finances and hope they sort themselves out on their own. But can you ever be happy with that weight on your shoulders? Start keeping a Money Diary today.